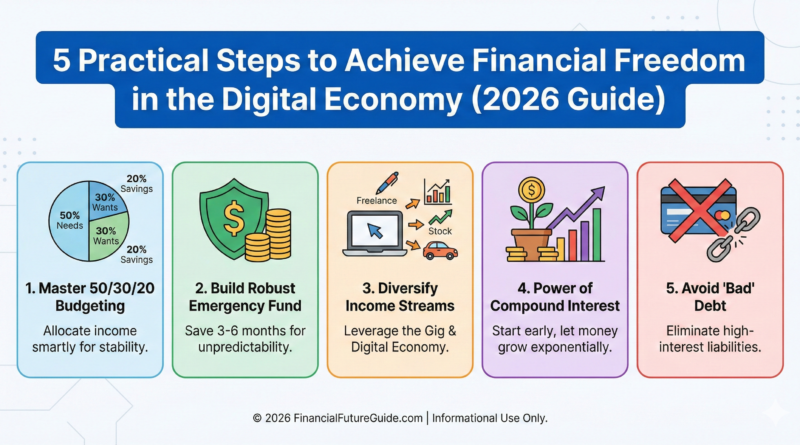

5 Practical Steps to Achieve Financial Freedom in the Digital Economy (2026 Guide)

Introduction

In today’s fast-paced digital world, the concept of financial freedom has evolved. It is no longer just about saving money in a bank account; it is about making your money work for you. Whether you are a student, a freelancer, or a full-time employee, mastering the art of personal finance is the first step toward a secure future. This guide outlines five practical, actionable strategies to take control of your wallet in 2026.

1. Master the 50/30/20 Rule of Budgeting

Budgeting is the backbone of financial stability. The most effective method for beginners is the 50/30/20 rule, popularized by Senator Elizabeth Warren.

- 50% for Needs: Allocate half of your income to essentials like rent, groceries, and utilities.

- 30% for Wants: Use this portion for lifestyle choices such as dining out, entertainment, and hobbies.

- 20% for Savings & Debt: This is the most crucial part. Direct this towards your emergency fund, retirement savings, or paying off high-interest loans.

2. Build a Robust Emergency Fund

Life is unpredictable. A sudden job loss or a medical emergency can derail your financial goals. Financial experts recommend saving at least 3 to 6 months of living expenses in a liquid account (like a high-yield savings account). This fund acts as a financial buffer, preventing you from falling into debt during tough times.

3. Diversify Your Income Streams

Relying on a single paycheck is a risky strategy in the modern economy. The rise of the “Gig Economy” has made it easier than ever to create secondary income sources. Consider:

- Freelancing: Monetize skills like writing, graphic design, or coding.

- Passive Income: Invest in dividend stocks or create digital products (e-books, courses).

- Side Hustles: Use platforms like Uber or Upwork to earn extra cash during weekends.

4. Understand the Power of Compound Interest

Albert Einstein reputedly called compound interest the “eighth wonder of the world.” The earlier you start investing, the more your money grows.

- Example: Investing $100 a month starting at age 25 yields significantly more by age 60 than starting at age 35, thanks to compounding.

- Start with low-risk Index Funds or ETFs if you are a beginner, and consult a financial advisor for personalized plans.

5. Avoid ‘Bad’ Debt Like the Plague

Not all debt is bad—mortgages can build equity—but high-interest consumer debt (like credit card balances) destroys wealth.

- The Avalanche Method: Focus on paying off debts with the highest interest rates first.

- The Snowball Method: Pay off the smallest debts first to build psychological momentum. Choose the method that keeps you motivated, but aim to be debt-free as quickly as possible.

Conclusion

Achieving financial freedom is a marathon, not a sprint. By adhering to a disciplined budget, building an emergency safety net, and diversifying your income, you can navigate the complexities of the modern economy with confidence. Start today—your future self will thank you.