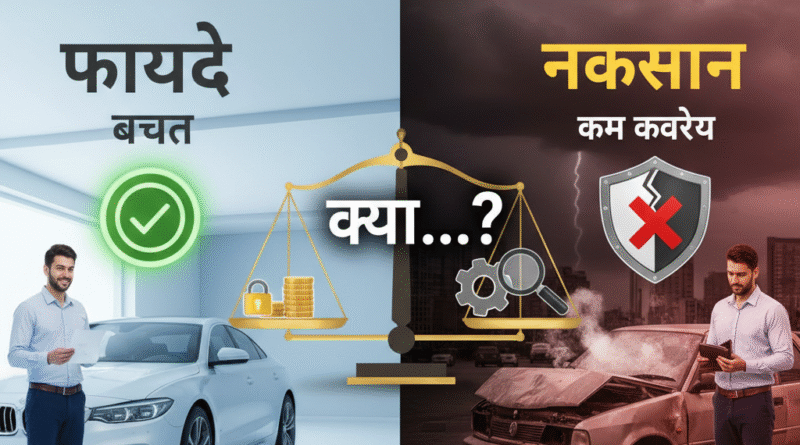

Is it always right to get cheap car insurance? Advantages and Disadvantages

Is it always right to get cheap car insurance? Pros and cons

Car insurance is a must for every vehicle owner today. Not only is it a legal requirement, it also keeps your vehicle and you safe from accidents or any unforeseen damages. Often, people look for cheaper options to reduce the insurance premium. But, is it always right to get cheap car insurance? Let’s take a look at its pros and cons.

Benefits of getting cheap car insurance

Savings: The biggest and most obvious benefit is saving money. Lower premiums mean less burden on your pocket. This is especially beneficial for people who use their car less or have a limited budget.

- Coverage as per your need: Sometimes, cheaper insurance is right for people who only need to meet legal requirements. For example, third-party insurance, which is mandatory in India, is usually the cheapest option. It only covers damage caused to a third party, which is sufficient for many people.

- Online availability: Many insurance companies offer affordable policies online. This makes it easier to compare premiums and choose the best option for your needs.

Disadvantages of buying cheap car insurance

- Low coverage: The biggest disadvantage of cheap insurance is low coverage. It often does not cover damage to your vehicle (such as accident, theft or natural disaster). If something happens to your vehicle, you may have to bear the entire cost of repairs yourself.

- Hidden charges and conditions: Many cheap insurance plans may have hidden conditions and clauses. When making a claim, you find out that certain types of damage are not covered or the deductibles are very high, which can take a toll on your pocket.

- Weak support service: Often, companies offering cheap policies have a slow claim settlement process and poor customer support. This experience can be frustrating when you need help the most.

- Lack of peace of mind: With a cheap and low coverage insurance plan, you may always be worried about what will happen if something happens to your vehicle. A comprehensive insurance plan gives you peace of mind because you know that your vehicle and you are protected.

Should you go for cheap insurance?

It completely depends on your needs and circumstances.

If you are driving an old vehicle with low market value and you just want to meet the legal requirements, then a cheap third-party insurance may be right for you.

If you have a new or expensive vehicle, or you live in an area where the risk of theft, flood or accident is high, then it is best to go for a comprehensive insurance, even if the premium is slightly higher. It protects you and your vehicle from future risks.